Hacking into Indonesia’s startup scene

Authors: Farinne Georgeopoulos and Tatika Catipay. Copyright © Exelix.

With an upbeat annual growth forecast of 5.2% from 2019 to 2023, the emerging Southeast Asian region promises to be an attractive haven for investors from developed countries, where economic growth has slowed down for the past decades. Undaunted by the rising tensions between the U.S. and China, bullish investors have confidence that Southeast Asia will be able to shield itself from the strained relations.

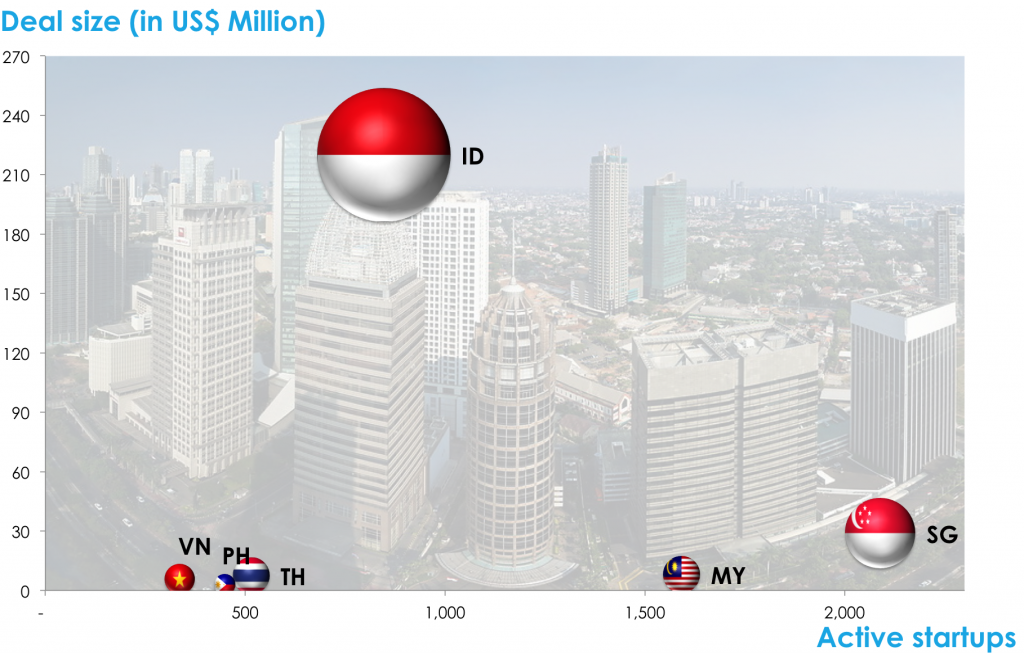

The undeterred rise of startups and unicorns presently in the region reflects a vote of confidence as they amass billions of funding internationally. Hitting an all time high in 2018, mega deals are becoming the norm as the region raised US$17.9 billion and is considered one of the fastest growing global hubs. In the same year, Southeast Asia recorded 5,828 active startups in the ASEAN-6.

Deal size is average funding per closed deal.

The leader of the pack in terms of the number of enterprises established in a country is Singapore, since it is the most developed country in the region. It is not surprising given that the country has long been touted as the gateway to the region for multinational companies. Its pluralistic society has welcomed immigrants from all over the world and has benefited from this spectrum of talents in its economic development. Singapore’s business-friendly legal framework proffers more investor protection encouraging investments. Hence, most startups in the region set up holding companies in the country for investment activities and move funds to their home country.

However, what comes as a surprise is Indonesia’s ascendancy in terms of deal size amongst its startups.

Indonesia: biggest and most attractive startup market in the region

Due to its sheer market scale, venture capitalists favor Indonesia as reflected in the funding they offloaded in the country in 2018, which was an average of US$220million per deal, the highest in the region, reflecting a wide gap from Singapore’s US$29million. Among these enormous investments, tech startups made up the bulk of the deals in Indonesia’s startup ecosystem.

Four out of 10 unicorns in Southeast Asia hail from Indonesia namely Go-Jek, Tokopedia, Traveloka and Bukalapak. These four startups operate as technology companies, offering an extensive array of services to the country’s massive online population, disrupting traditional businesses and improving, especially lives among the mass base of people.

The first unicorn in Indonesia is Go-Jek, an online marketplace for customers and service providers with modest beginnings as a motorcycle-taxi hailing app.

Go-Jek mobile app

It has now expanded to over 15 other on-demand transport and lifestyle services such as taxi hire, delivering groceries, e-wallet services, instant-food delivery, on-call massage, personal grooming services and home cleaning.

Tokopedia and Bukalapak are both e-commerce platforms that allow individuals and small enterprises to sell and buy their products online. Tokopedia is a free online marketplace for individuals and business owners while Bukalapak caters to small store owners with kiosks or stalls located mostly along the roadside and connects them to the internet.

On the other hand, Traveloka provides travel services through their mobile app and online platform, and has also evolved into a bills payment and lifestyle hub for Indonesia’s middle and lower classes.

What spurred Indonesia’s startup growth?

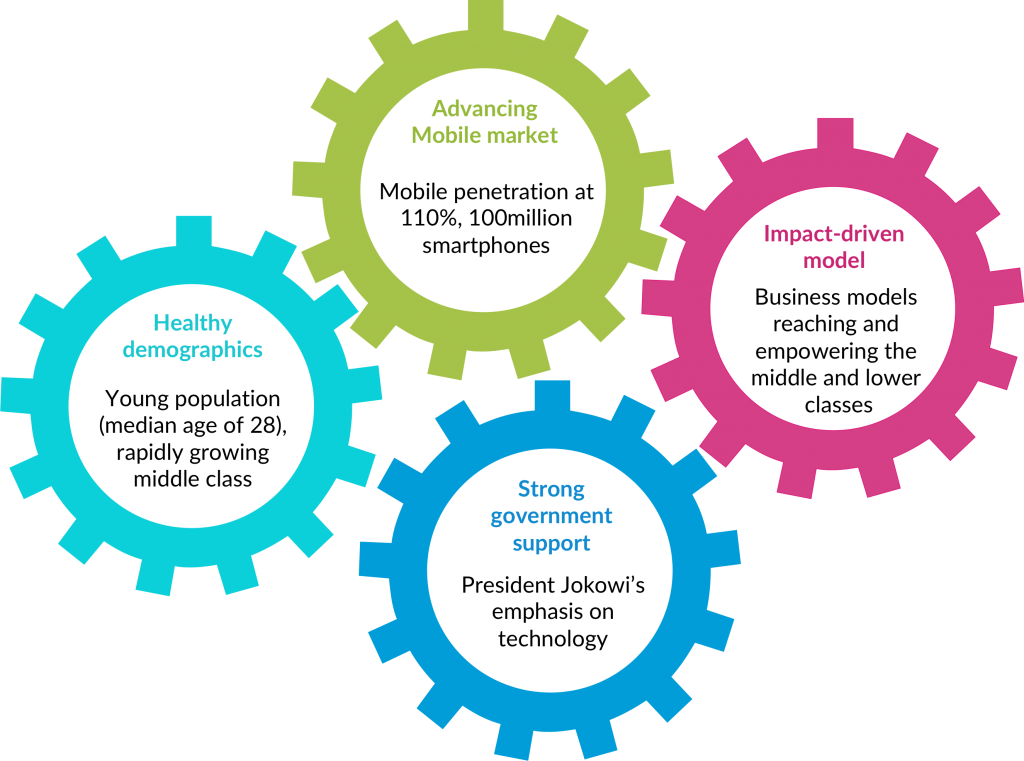

1) Demographics. Home to 264million people, 24% of whom are millennials makes Indonesia an attractive hotspot for investors. Against this backdrop, the country’s middle class thrives in 19.6 million households, which makes it the fourth largest in the world. This is a critical mass promising high investment growth potential. Since 2012, the country has received the most number of venture capital among emerging markets and has been ranked first in the startup frontier markets.

2) Market. In 2019, Indonesia recorded a surge in Internet users at 171 million, which is 65% of the population.

63.4million of these users are tech-savvy millennials and this stimulates the huge appetite for digital consumption in both, the country’s urban as well as rural areas. This robust wave and its potential for growth is what startups and unicorns have been capitalising on.

3) Government. The current government’s emphasis on technology as one of the driving forces for economic growth has led it to ambitiously aim at producing 20 more unicorns by 2025. This earnest vision is promoted by the Indonesian government’s programmes to support the digital ecosystem such as Nexticorn, SMEs Go Online, etc. and its promises to bolster e-commerce.

In 2018, President Joko Widodo launched the “Making Indonesia 4.0” programme to equip the country to become more competitive in the global digital market. This has helped cement Indonesia’s trajectory to becoming a digital economy, where startups thrive and flourish.

4) Impact-driven model. Whilst a lot has been written about Indonesia’s healthy demographics, tech-savvy market and pro-technology government, the business model from which these unicorns were originally formed is not sufficiently highlighted.

Indonesia is home to ~63million millennials

The drivers of Indonesia’s startup scene

If we delve deeper, what Go-Jek, Tokopedia, Traveloka, and Bukalapak have in common is their model — to improve the lives of the Indonesian masses by providing a plethora of opportunities and a market to the lower class. This model includes the ‘unbankable’ sector where people have no assets, no credit, no savings — by giving them a livelihood, providing them access to resources and empowering them through technology.

Go-Jek driver waiting for a passenger alongside a street in Jakarta

Go-Jek, for example, began with 20 motorbikes called ojek, the primary and only way most people move around; cars and taxis are a luxury only the rich can afford. In the streets of Jakarta, one can observe ojek drivers everywhere, waiting to pick up passengers, mostly ordinary people to help them with their transport needs. Seeing this tremendous potential market, Go-Jek capitalised on it by enabling the booking of ojeks as a taxi service through the use of a smartphone, thus catering to the transport needs of ordinary people more efficiently.

This impact model is also what Bukalapak adopted. By digitising street stall vendors, who are selling products via road-side kiosks called warung. Bukalapak is a platform for these vendors to shop their products online with no fee and acts as a cheaper middleman in the supply chain by cutting the wholesalers and distributor sales agents. As most of these vendors are from the older generation, not the usual tech savvy millennials targeted by most technology company, this startup ensures the platform is simple and easy to understand. Bukalapak has not only empowered this sector of society but successfully integrated them into the digital economy.

As a region, Southeast Asia is home to 75%-80% of the unbanked population. Most of the traditional businesses have been eluding this sector of society because of its perceived financial risk.

Nonetheless, the crux of these unicorns successes in a developing country like Indonesia is hard to over look.

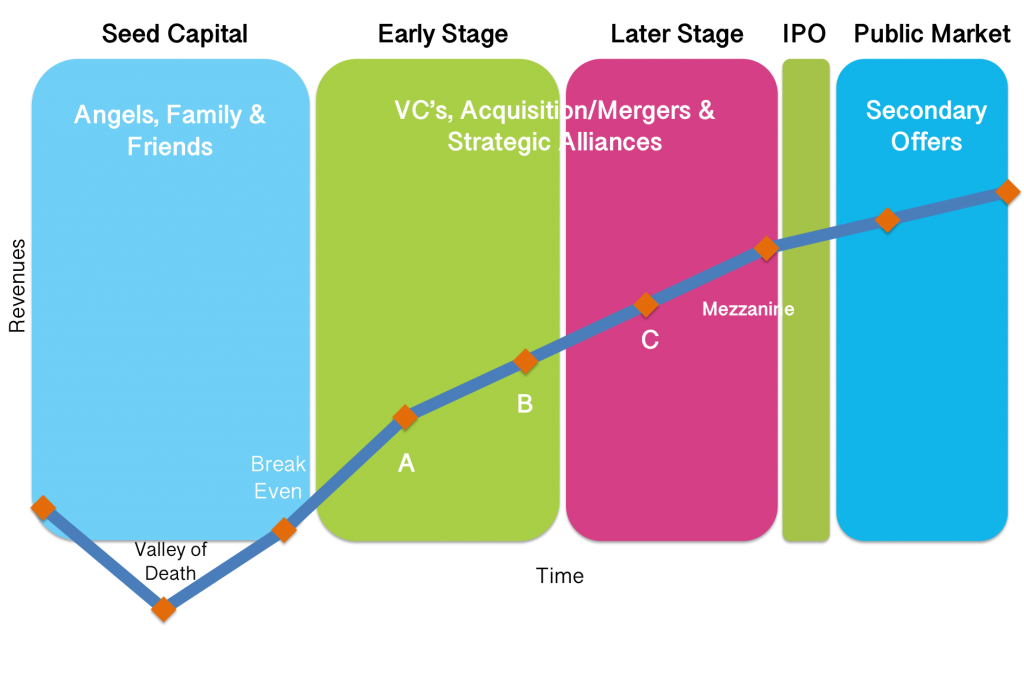

Indonesia startup ecosystem: challenges

Concurrent with a promising landscape, startups in the country are also besieged with obstacles. For most startups, funding is a major deterrent in effectively scaling up. On a regional level, funding at the seed and series A stages has transpired but it is unanimously agreed and observed by investors that a shortage exists of Series B funding. This is because most startups are required to demonstrate a working market strategy and a clear path to profitability. There are only a few funds that have ventured into writing cheques for more than US$7million in Southeast Asia.

One of the many arguments for this inconsistency is that a lot of the startups’ business models are improbable. Side by side with a diverse market, most of these startups have unique and unproven business models. Rather than focusing on developing more workable and feasible models, the focal point of most founders is racking up funding after funding in order to survive. A sustainable business model is imperative to assure investors and to persuade them to write bigger cheques.

Another ubiquitous setback faced by startups in Indonesia and the Southeast Asian region is poor quality and small quantity of talent owing to limited experience, lack of technical competencies (eg. market-execution skills), widespread poaching and glaring shortage of highly qualified and suitable candidates.

The way forward

“Chase the vision, not the money; the money will end up following you.”

— Tony Hsieh, CEO, Zappos

A fundamental element for startups to sustainably scale up is the consideration of incorporating an impact-driven model of reaching the mass base of people, every step along the way as part of a clear path towards profitability. Albeit profit being an important driver to scaling up and growing the business, it should not lose sight of its social responsibility and ethos as to why it was ignited and the product created in the first place.

Being mindful of this can invigorate employees, the investor, and even, customers in developing a better product that could potentially revolutionise and create an impact on society.

In the emerging countries of Southeast Asia, particularly Indonesia, it cannot be denied that the rise of unicorns like Go-Jek, Bukalapak, Tokopedia and Traveloka is closely tied with creating viable business models that are aimed at the still largely untapped sector of the masses. This stratum of society comprises the population segment that offers massive potential for businesses.

Understanding this latent sector is crucial to unlocking potentials of the Indonesian market as well as its developing Southeast Asian neighbours.